VATupdate on Twitter: "NETHERLANDS Sale of boilers results in fixed establishment for VAT in the Netherlands https://t.co/j4mSz1FCHc #gst #news #tax #vat #salestax #tax Subscribe to our free weekly newsletters: https://t.co/RzVlwjOFKh… https://t.co ...

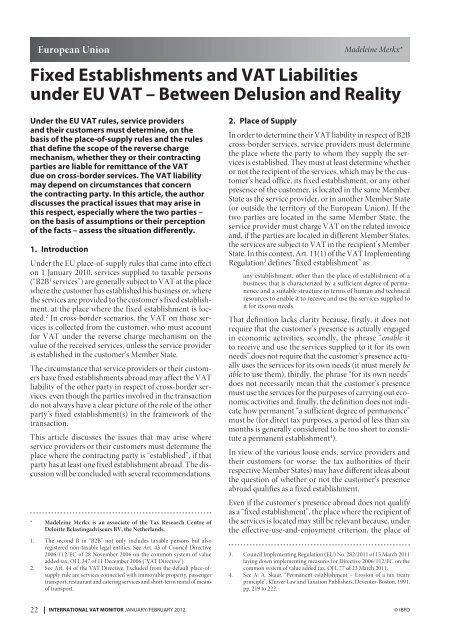

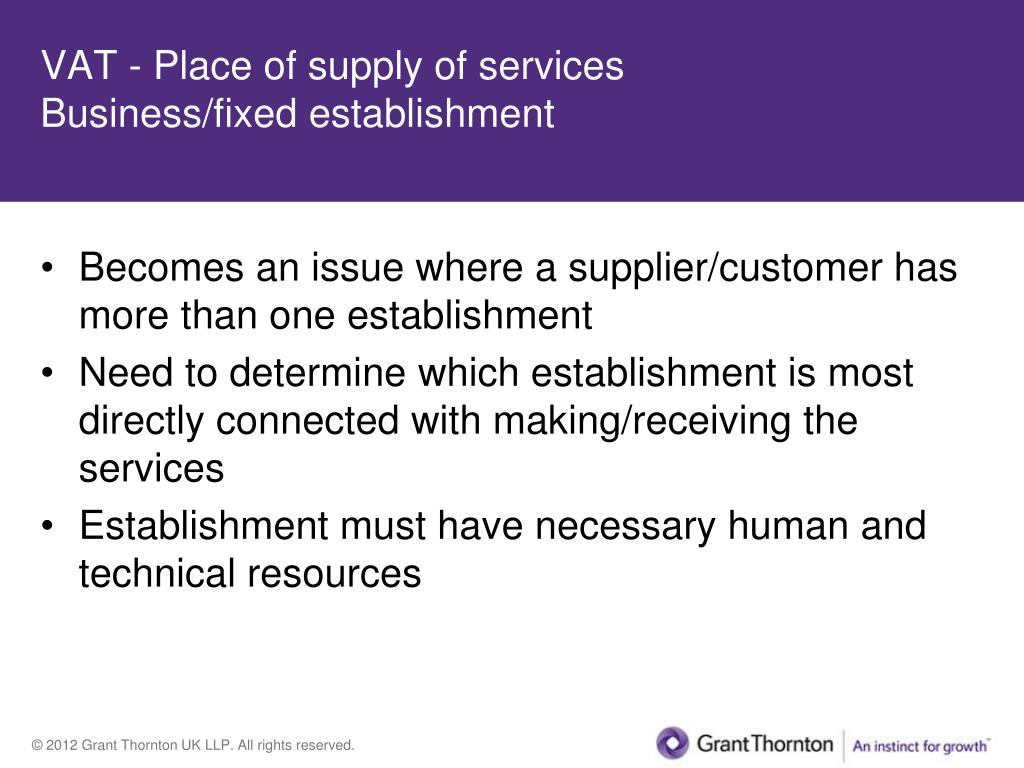

What is tax grouping? Will your business be grouped for vat in UAE? by FAR-Farhat Office & Co. - issuu