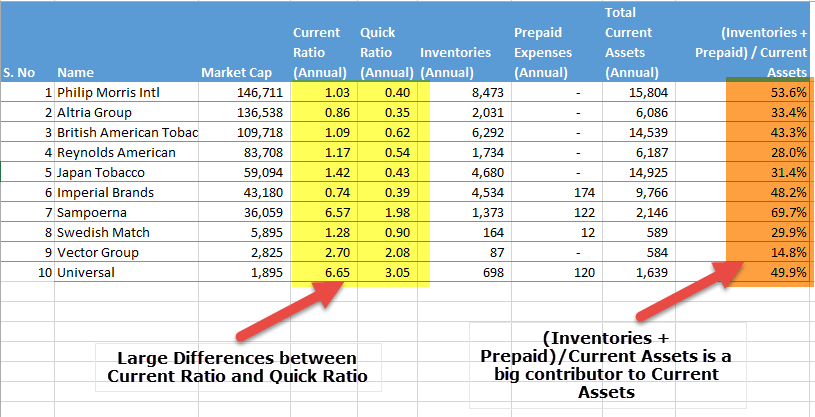

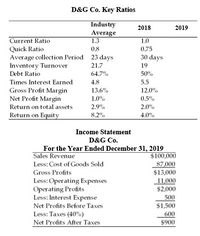

Current Assets Compared with Current Liabilities in Financial Reporting and Analysis Tutorial 29 October 2022 - Learn Current Assets Compared with Current Liabilities in Financial Reporting and Analysis Tutorial (12505) | Wisdom Jobs India

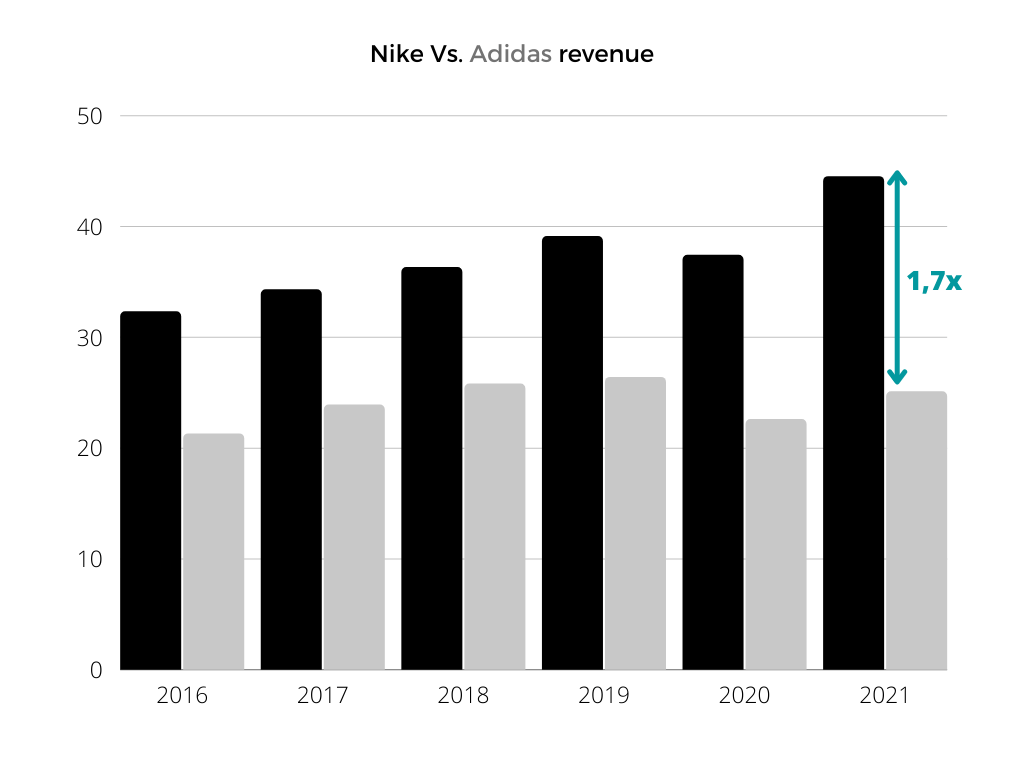

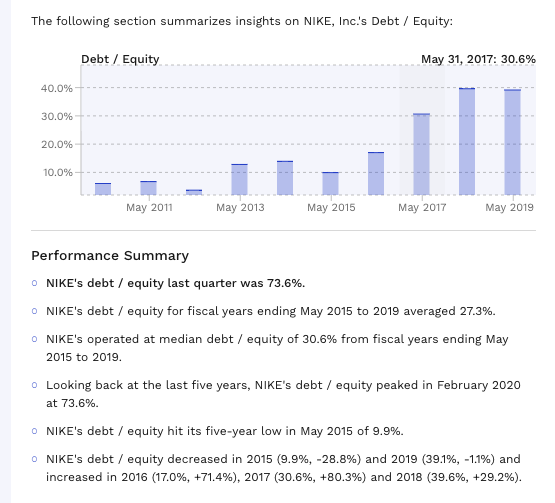

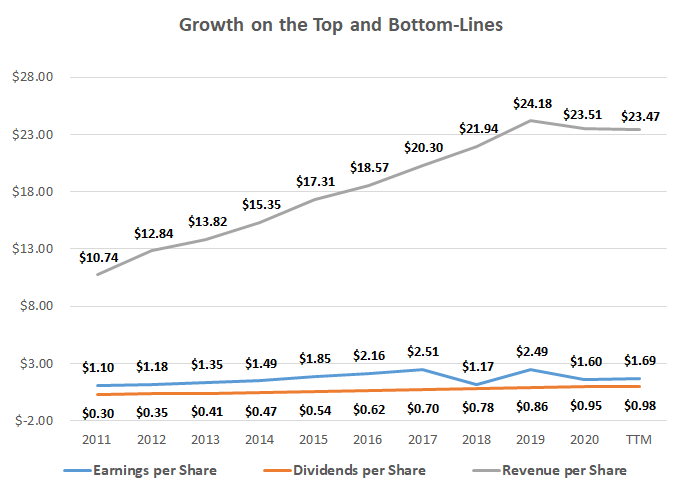

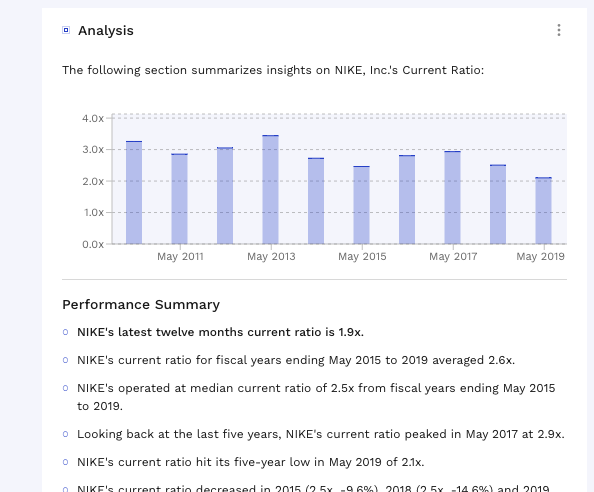

Four Things to Consider When Investing in a Company: A Nike Case Study | by World Business Bites | Medium

Analysis of Nike in Financial Reporting and Analysis Tutorial 05 November 2022 - Learn Analysis of Nike in Financial Reporting and Analysis Tutorial (12530) | Wisdom Jobs India

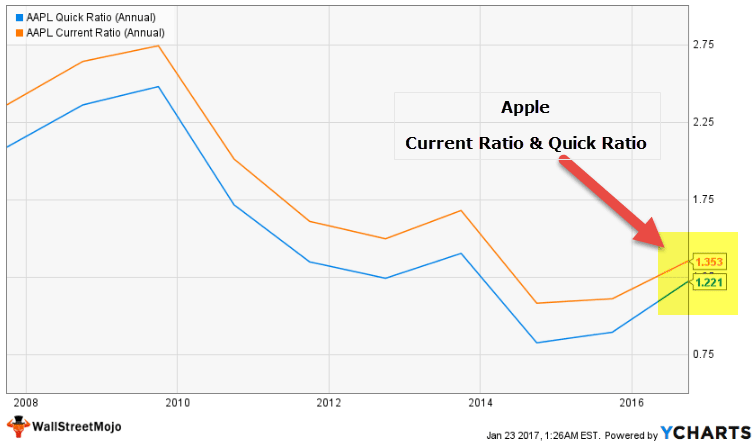

![PDF] STUDY OF RELATIONSHIP BETWEEN LIQUIDITY RISK(QUICK RATIO) AND INTERNAL AND EXTERNAL FACTORS IN NIKE COMPANY PDF] STUDY OF RELATIONSHIP BETWEEN LIQUIDITY RISK(QUICK RATIO) AND INTERNAL AND EXTERNAL FACTORS IN NIKE COMPANY](https://i1.rgstatic.net/publication/329642793_STUDY_OF_RELATIONSHIP_BETWEEN_LIQUIDITY_RISKQUICK_RATIO_AND_INTERNAL_AND_EXTERNAL_FACTORS_IN_NIKE_COMPANY/links/5c135ab1a6fdcc494ff2d6c0/largepreview.png)

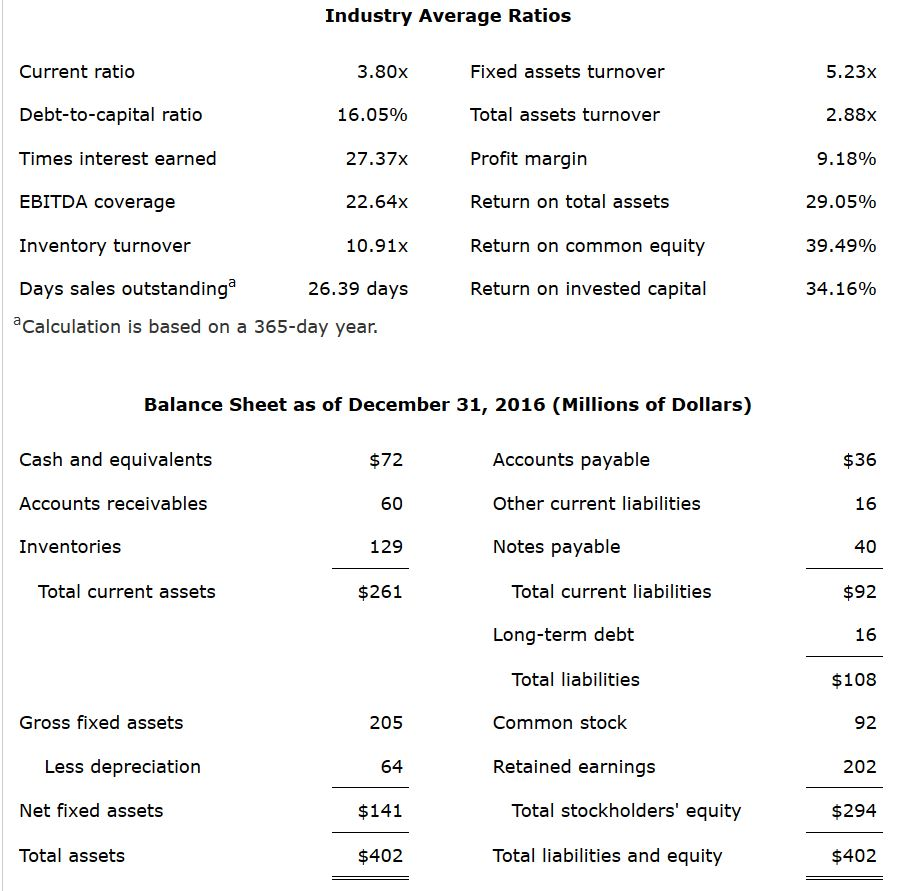

.png)