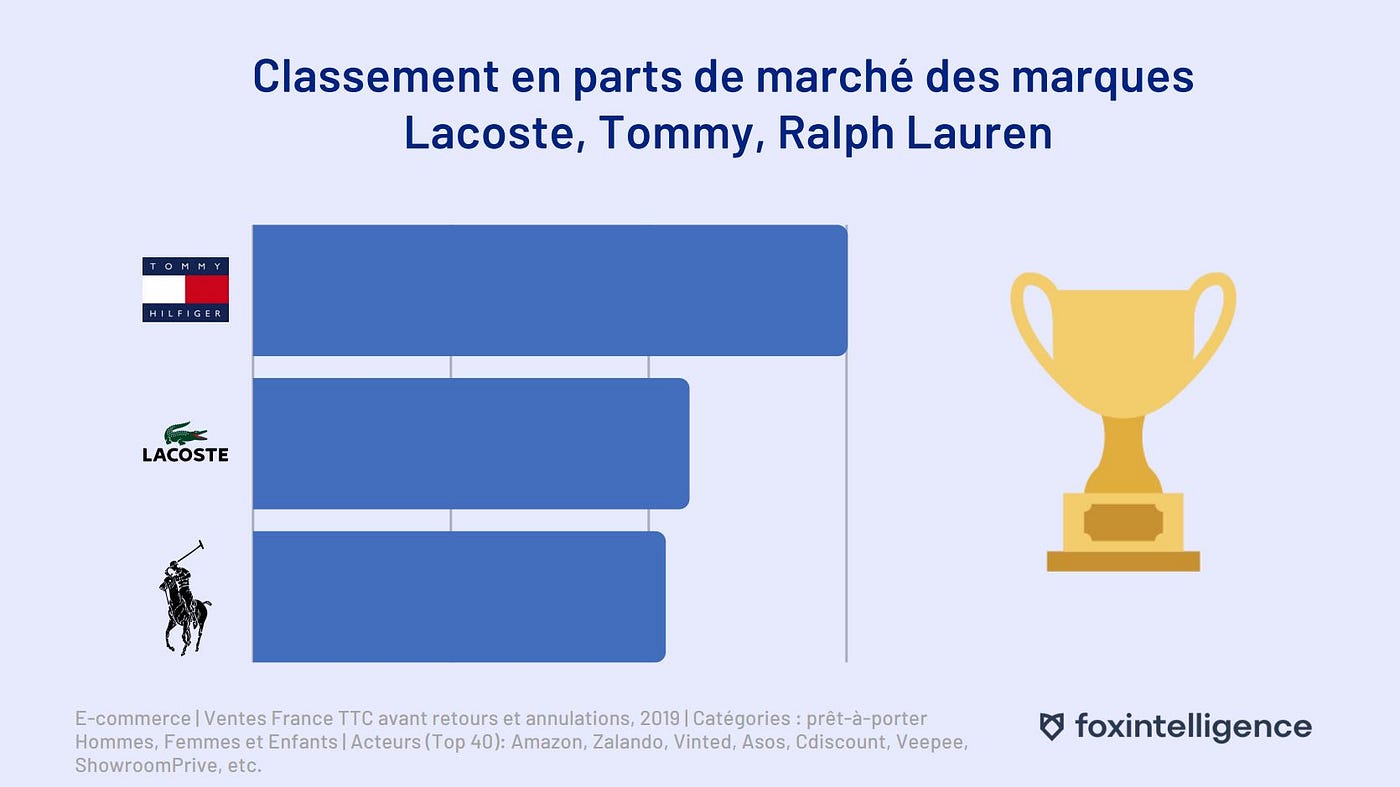

Vente-Exclusive NL: This week: Tommy Hilfiger, Eastpak, Gaastra, Philips, Timberland, Someone, Scapa & Scapa Sports, Emporio Armani, Gap on vente-exclusive.com | Milled

Tommy Hilfiger su Veepee! | Per aggiungere colore ai tuoi look punta tutto su Tommy Hilfiger su Veepee! 😁 | By Veepee | Facebook