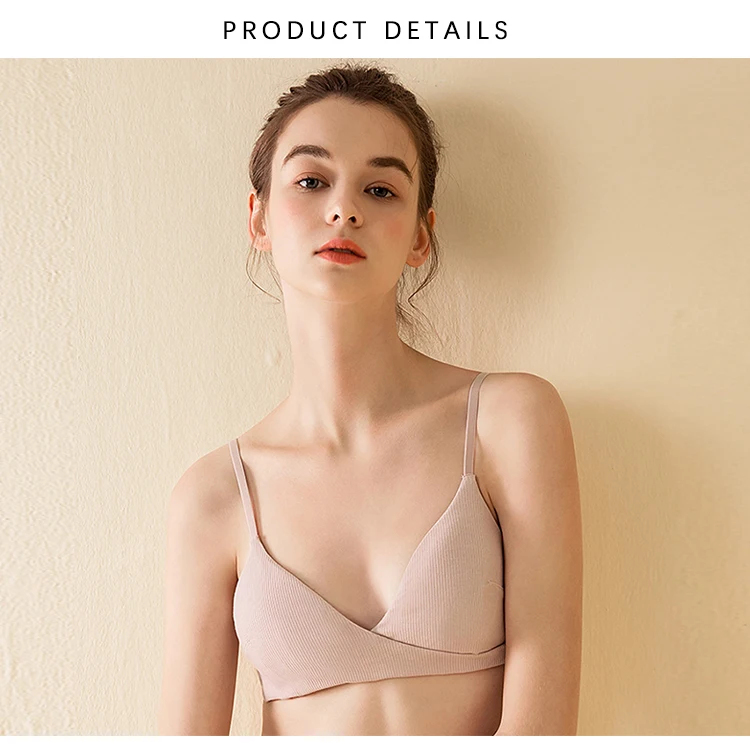

Kernelly - Women Backless Sexy Bra Stylish Lace Seamless Bralette Triangle Cup Invisible Boneless Bras For Dress Soft Thin Underwear - Walmart.com - Walmart.com

Best Bras Dd Cup Good For Large Bust 34dd Bra Size Bikini - Buy Best Bras For Dd Cup,Good Bra For Large Bust,34dd Bra Size Product on Alibaba.com